INFOGRAPHIC/ Jessica Lu & Melissa Olivares

By Ella Chan,

Staff Writer

Entering your apartment, you slide to the floor, exhausted after a full 10 hours at work. In 15 minutes, you have to head back out to your night job. After, you’ll sleep maybe three hours before returning to your day job. Tomorrow is a tiring repeat of today.

For many new college graduates, this is life for them. In addition to bills, groceries and paying for other life essentials, graduates exhaust themselves paying off student debts. Higher education costs are too expensive to be feasibly payable for most Americans.

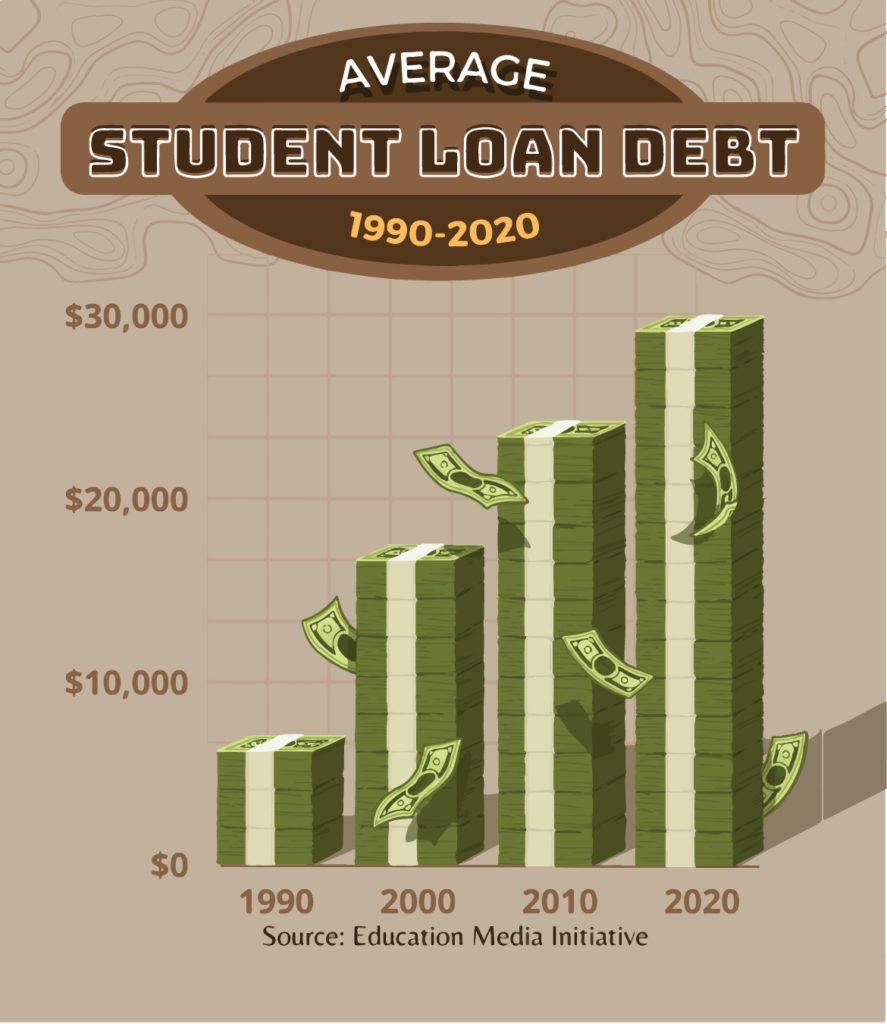

According to CNBC, while college prices increased by approximately 169% from just 1980 to 2019, the average income for young workers increased only 19%. With the cost of higher education skyrocketing over the past decade, student loans increased in size as well, leading to extreme student debt: the Education Data Initiative states that the student loan debt balance increased by 8.28% in 2020 alone.

Finding a balance between accessibility to higher education and funding for it is the domineering issue. As state financing for higher education is continuously cut, colleges rely upon students to pay for their programs and therefore increase tuition and fees in order to fund programs alongside any increases made purely for profit. In fact, stated by CNBC, from just 2009 to 2019, the state funding for higher education decreased by $9 billion.

While the federal student loan program is designed to give students support and time, it fails to provide aid necessary with the disparity between higher education prices and worker wages.

Moreover, there currently are no measures preventing students from taking on loans to attend for-profit higher education institutions. This means students are already set up for debt because the price of higher education increases at a rate exponentially larger than an average worker’s income. They find themselves in extreme debt for education not worth the amount they paid for.

A good start to reform would be to renew the restrictive measures that canceled federal funding to for-profit colleges and helped prevent students from taking loans for these institutions, but more changes to the system must be made. Begin small by contacting your state and federal representatives to advocate for increased state funding for higher education, free community college and college loan forgiveness. Voters can elect local politicians that support canceling student debt and/or want to lower the cost of higher education.

While some would say that restricting federal loans and increasing state funding for higher education and free community college would cause taxpayers to pay higher tax rates, this does not have to be true. By rerouting the funds that were cut from state funding back to higher education, the funds are merely shifted, rather than increased.

Education is a human right, and everyone deserves a chance to receive higher education. However, this right must be provided at a fair price in which students don’t need to sacrifice their entire livelihood in order to access it. To achieve this, our current system requires reform.